Imagine staring at your single rental property, wondering if it will ever grow into something bigger, something that truly builds lasting wealth. You are not alone: countless aspiring investors start with one asset but get overwhelmed by the idea of scaling. This article provides a clear, step-by-step guide on how to build a real estate portfolio, turning that initial investment into a thriving, diversified business. We will cover essential strategies like property diversification, cash flow analysis, and the BRRRR method, while addressing risks and inspiring you to act. Whether you are house hacking your way in or aiming for retirement security, this masterclass equips you with the tools to scale confidently and achieve financial freedom.

Why Build a Real Estate Portfolio?

Building a real estate portfolio goes beyond owning a few properties: it is about creating a system that generates passive income, builds equity growth, and hedges against economic shifts. In 2026, with housing markets rebounding and mortgage rates stabilizing around 6-7%, real estate remains a proven path to wealth. Unlike stocks, properties offer tangible assets that appreciate over time, often outpacing inflation.

Why does this matter to you? If you are an aspiring investor or house hacker, a portfolio provides multiple income streams, reducing reliance on a single property. For intermediate investors, it means transitioning to a scalable business with better tax advantages and risk spread.

Consider this: investors who diversify across asset classes see steadier returns, even in volatile real estate market cycles. Ready to start? Let us dive into the steps.

Step 1: Set Clear Investment Goals

Before buying anything, define what success looks like. Do you want steady cash flow for retirement, or rapid equity growth through flips? Goals shape your strategy.

Ask yourself: How many properties do you aim for in five years? What monthly income target excites you? For retirement-focused investors, aim for a portfolio yielding 8-10% annually through rentals.

Write them down. Specific goals keep you motivated and guide decisions, like choosing cash-flowing multifamily units over high-appreciation single-families.

Step 2: Educate Yourself on Real Estate Fundamentals

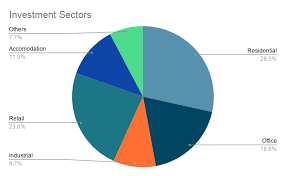

Knowledge is your foundation. Start by understanding real estate asset classes, from residential (single-family, multifamily) to commercial (office, retail) and industrial. Each offers unique benefits: residential for stability, commercial for higher yields.

Next, grasp real estate market cycles. In 2026, experts predict a rebound with modest price growth (3-5%) and increased inventory, making it buyer-friendly in many areas. Cycles include expansion, peak, contraction, and recovery: buy low in recovery phases for best deals.

Read books like “Rich Dad Poor Dad” or join forums on BiggerPockets. Pro tip: Attend local investor meetups to learn from mentors.

Step 3: Assess Your Financial Situation

Take stock of your finances. Calculate your net worth, credit score, and savings. A strong credit score (above 700) unlocks better loans.

Budget for down payments, typically 20-25% for investment properties. If funds are low, explore creative options later.

Tools like personal finance apps help track expenses. Remember, scaling requires discipline: avoid lifestyle creep as income grows.

Step 4: Choose Your Investment Strategy

Your strategy aligns with goals and resources. Popular ones include house hacking, BRRRR method, and comparing REITs vs. physical property.

Building a Real Estate Portfolio Through House Hacking

House hacking lets you live in one unit while renting others, often covering your mortgage. Buy a duplex, live in one side, rent the other: instant cash flow with low entry.

In 2026, with FHA loans allowing 3.5% down, it is accessible. Example: A $300,000 duplex might rent for $1,500 per unit, offsetting costs and building equity.

Pros: Low risk, hands-on experience. Cons: Shared living. Ideal for starters.

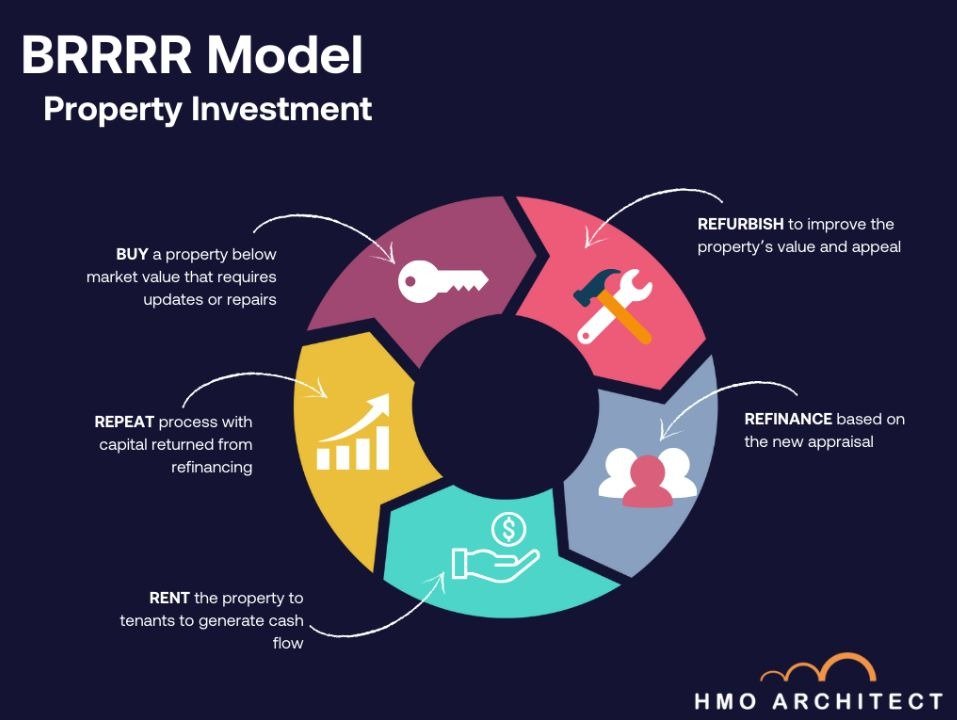

The BRRRR Method

BRRRR (Buy, Rehab, Rent, Refinance, Repeat) recycles capital. Buy undervalued property, rehab it, rent it, refinance to pull out equity, repeat.

In 2026, with rates steady, focus on stabilizing properties quickly for refi. Example: Buy for $100,000, rehab $30,000, appraise at $180,000, refi 75% ($135,000), recover investment.

Pitfalls: Over-rehabbing. Aim for 70% ARV rule.

REITs vs. Physical Property

REITs offer passive investing without management hassles, but lack control. Pros: Liquidity, diversification. Cons: No leverage, market volatility.

Physical properties build equity faster but require effort. Choose based on time: busy? REITs. Hands-on? Physical.

READ ALSO: Real Estate vs. REITs: Which Is Better?

Step 5: Find and Analyze Deals

Hunt deals on MLS, Zillow, or networks. Analyze rigorously.

Cash Flow Analysis

Cash flow analysis subtracts expenses from income. Formula: Rental Income – (Mortgage + Taxes + Insurance + Maintenance) = Cash Flow.

Aim for positive $200+ per unit. Use spreadsheets for projections.

Cap Rate

Cap rate measures return: NOI / Property Value. Example: $20,000 NOI on $250,000 property = 8% cap rate. Higher is better for income-focused.

Step 6: Finance Your Investments

Secure funding creatively.

How to Build a Real Estate Portfolio with No Money Down

Options: Seller financing, house hacking with low-down loans, or HELOC on primary residence. Partner with investors for equity splits.

In 2026, DSCR loans focus on property income, not yours.

Step 7: Acquire and Manage Properties

Close deals with inspections. Then, manage efficiently.

Property Management Systems

Use software like AppFolio or Stessa for tracking rents, maintenance. Automate to scale.

For multi-state, hire local managers.

Step 8: Scale and Diversify

Grow by reinvesting profits.

Property Diversification

Spread across types, locations to mitigate risks. Example: Mix residential, commercial in different states.

1031 Exchange

Defer taxes by swapping properties. Rules: Like-kind, 45-day identification, 180-day close.

Managing a Multi-State Real Estate Portfolio

Use tech for oversight, build teams per state. Diversify to capture growth in hot markets like Texas, Florida.

Best Strategies for Scaling a Rental Property Business

Leverage systems: Outsource management, optimize rents, diversify. In 2026, focus on niches like short-term rentals.

Risk Management in Real Estate

Identify risks: Vacancies, repairs. Mitigate with insurance, reserves (3-6 months expenses). Monitor cycles to time buys.

How to Build a Real Estate Portfolio for Retirement

Target cash-flowing assets. Aim for $5,000+ monthly. Use 1031 to grow tax-free, transition to passive REITs later.

You have covered the basics: now imagine applying these steps. Building a portfolio is a journey, but with discipline, it leads to freedom.

Summarize: Set goals, educate, analyze, finance creatively, manage smartly, diversify. Avoid pitfalls like over-leveraging.

Ready to act? Consult a real estate mentor or advisor today to review your first deal. Your wealth-building starts now.

YOU MAY ALSO LIKE: Real Estate Due Diligence Guide