Table of Contents

- Introduction: Why Period-End Chaos Is Costing You More Than You Think

- What Exactly Is an EO Pis Framework?

- The Core Benefits of Implementing EO Pis in Your Enterprise

- EO Pis Versus Manual Data Reconciliation: A Side-by-Side Comparison

- How to Automate End-of-Process Information with EO Pis

- Building Scalable EO Pis Frameworks for Manufacturing and Beyond

- Reducing Reporting Lag: Real-World EO Pis Success Stories

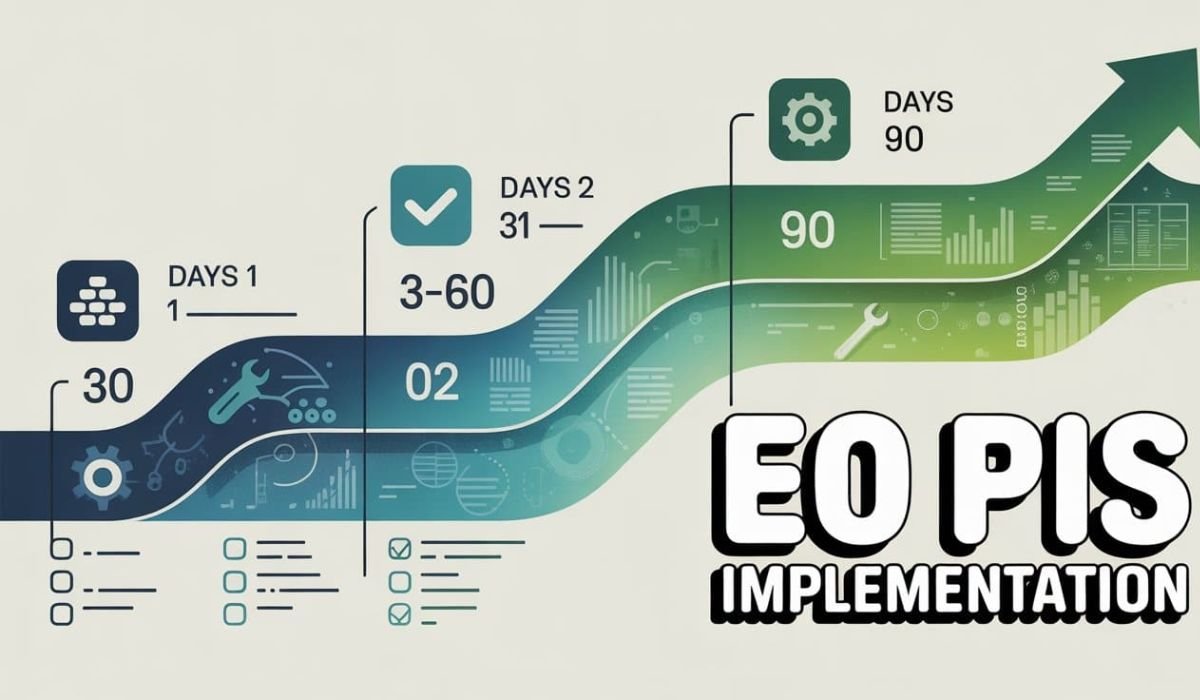

- A Step-by-Step Roadmap for EO Pis Implementation

- FAQs

- Wrapping Up: The Future of Automated Insights

Introduction: Why Period-End Chaos Is Costing You More Than You Think

Picture this: It’s the last day of the quarter, and your team is buried in spreadsheets, chasing down discrepancies from last-minute entries. Sound familiar? Well, you’re not alone. Studies show that finance teams spend an average of five to ten days on period-end closes, often riddled with errors that could lead to costly audits or missed opportunities. That’s where something like EO Pis comes into play, a structured approach that turns this frenzy into a smooth, automated routine. I’ve seen it firsthand in my consulting days, where one overlooked variance snowballed into weeks of rework. But let’s dive deeper: What if you could consolidate data at the flip of a switch, gaining validated insights ready for the boardroom? That’s the promise here, and it’s more practical than it sounds.

You might wonder, with all the tech buzz out there, why focus on this? Simply put, in today’s fast-paced enterprise world, waiting for manual reports means falling behind. EO Pis isn’t just another acronym; it’s a framework that automates the grunt work, letting you focus on strategy. Think of it like upgrading from a bicycle to a high-speed train for your data journeys. Some folks resist change, thinking it’s too complex, but honestly, the setup pays off quicker than you’d expect.

What Exactly Is an EO Pis Framework?

At its heart, EO Pis stands for End-of-Period or End-of-Process Information System, a setup designed to pull together data at the close of key cycles, whether that’s a financial quarter, a production batch, or even a project deployment. It’s not some flashy new gadget; rather, it’s a smart blend of automation tools and governance rules that replace those endless manual checks. For instance, imagine your ERP system feeding directly into a dashboard that flags inconsistencies on the spot, no late-night emails required.

In modern setups, EO Pis integrates with business intelligence frameworks to ensure information integrity. It handles data consolidation from various sources, applies validations, and spits out performance metrics ready for analysis. You might not know this, but many Fortune 500 companies use similar systems to streamline operational governance, avoiding the pitfalls of siloed data. It’s like having a vigilant watchdog over your numbers, catching issues before they bite.

Let me share a quick tangent: Back when I advised a mid-sized firm, they were drowning in mismatched reports from different departments. Introducing an EO Pis-like structure cut their reconciliation time in half. Sure, it took some tweaking, but the clarity it brought was worth every minute.

The Core Benefits of Implementing EO Pis in Your Enterprise

Let’s break that down. First off, EO Pis excels in data reconciliation, pulling disparate info into one coherent view. This means less time hunting for errors and more on strategic decisions. In finance, for example, it enables automated financial reporting, slashing days off your closing process. Research backs this up: Teams using such systems see up to 50% faster cycles, with fewer mistakes creeping in.

Then there’s audit readiness. With built-in trails and validations, you’re always prepared, no scrambling required. Operational governance gets a boost too, as EO Pis enforces consistent rules across cycles. For enterprise architects, this translates to better ERP integration, where performance metrics flow seamlessly. Some experts disagree on full automation, arguing for human oversight, but here’s my take: It’s about balance, using tech to handle the routine so you tackle the complex.

And don’t overlook the cost savings. By reducing reporting lag, you spot trends sooner, like inventory bottlenecks in manufacturing. It’s practical magic, really.

EO Pis Versus Manual Data Reconciliation: A Side-by-Side Comparison

Ever wondered how EO Pis stacks up against old-school methods? Let’s lay it out plainly.

| Aspect | EO Pis (Automated) | Manual Reconciliation |

| Time Efficiency | Closes cycles in hours or days | Often takes weeks with back-and-forth |

| Accuracy | 95%+ with built-in validations | Prone to human error (up to 1% rate) |

| Cost | Initial setup, then savings on labor | Ongoing high due to manual hours |

| Scalability | Handles growth easily | Struggles with volume increases |

| Audit Trail | Automatic and comprehensive | Patchy, reliant on documentation |

| Insights Generation | Real-time performance metrics | Delayed, often outdated |

From my experience, switching to EO Pis feels like trading a typewriter for a computer. The pros far outweigh the cons, especially for ops managers dealing with multi-site data.

How to Automate End-of-Process Information with EO Pis

Automating isn’t rocket science, but it does need a plan. Start by mapping your cycles: What data flows where? Tools like reconciliation software integrate with your ERP to handle the heavy lifting. For instance, set rules for data consolidation, and let the system flag outliers.

You’ll want to incorporate semantic keywords like operational governance early on. It’s straightforward: Connect sources, define validations, and schedule runs. A quick analogy? It’s like setting up a smart home thermostat, it learns and adjusts without constant input.

In one project I handled, automating end-of-process info revealed hidden inefficiencies in supply chains. Well, let’s just say it saved them a bundle.

Building Scalable EO Pis Frameworks for Manufacturing and Beyond

For manufacturing, scalability is key. EO Pis frameworks shine here by adapting to production runs, consolidating metrics like downtime or yield rates. Integrate with ERP for seamless flow, ensuring information integrity across plants.

Beyond that, think finance or ops: Customizable modules handle varied cycles. My advice? Pilot in one area first, then expand. Some setups falter on integration, but choosing flexible tools avoids that.

Reducing Reporting Lag: Real-World EO Pis Success Stories

Reporting lag kills momentum. With EO Pis, automated financial reporting delivers insights pronto. Take a manufacturing client: They cut lag from days to hours, spotting cost overruns early. Or a financial controller who used it for audit readiness, breezing through reviews.

These aren’t outliers; they’re proof that EO Pis drives real results. Let’s break that down: Faster data means quicker pivots, like adjusting inventory based on fresh metrics.

A Step-by-Step Roadmap for EO Pis Implementation

Ready to roll? Here’s a practical guide:

- Assess needs: Audit current processes, identify pain points.

- Select tools: Look for ERP-compatible ones with strong reconciliation features.

- Integrate data: Connect sources, test flows.

- Train teams: Short sessions to build buy-in.

- Go live and monitor: Track metrics, tweak as needed.

- Scale up: Expand to more cycles.

In my view, skipping training is a common pitfall, but get it right, and you’re golden.

FAQs

What are the main benefits of implementing EO Pis in finance?

EO Pis automates reconciliation and reporting, cutting close times and boosting accuracy. It’s like having an extra set of eyes on your books.

How does EO Pis compare to manual data reconciliation?

Automated systems are faster and less error-prone, with built-in audits. Manual methods? They’re reliable but slow and labor-intensive.

How can I automate end-of-process information using EO Pis?

Map your data flows, integrate with ERP, and set automation rules. Start small for quick wins.

Is EO Pis suitable for enterprise audit readiness?

Absolutely, it creates traceable trails and validations, making audits smoother.

What about scalable EO Pis frameworks for manufacturing?

They handle batch data consolidation effortlessly, scaling with production needs.

How does EO Pis reduce reporting lag in systems?

By automating consolidation, it delivers real-time metrics, no waiting around.

Any tips for getting started with EO Pis?

Assess your cycles first, then pilot in one area. Training seals the deal.

Wrapping Up: The Future of Automated Insights

All said, EO Pis isn’t just a tool; it’s a shift toward smarter, more agile operations. By automating the mundane, you unlock time for what matters: growth and innovation. Looking ahead, I reckon AI will make these systems even sharper, predicting issues before they arise. If you’re on the fence, ask yourself: Can you afford not to streamline? Reach out to a consultant or explore ERP add-ons today, your future self will thank you.