In 2025, with the U.S. housing market showing modest price growth of around 3% and mortgage rates hovering in the mid-6% range, many individual investors are exploring real estate exposure for diversification and passive income. But should you buy physical properties or invest in Real Estate Investment Trusts (REITs)?

The debate of real estate vs. REITs: which is better comes down to your goals, risk tolerance, and time commitment. Direct ownership offers hands-on control and potential tax advantages, while REITs provide easy liquidity and professional management. This guide breaks down the key differences to help you decide what fits your portfolio best—whether you’re a beginner seeking low-entry options or a seasoned investor balancing active and passive streams.

What Are Direct Real Estate Investments?

Direct real estate investing means owning physical assets like single-family rentals, multifamily units, or commercial properties. You collect rent, benefit from appreciation, and make all decisions—from tenant screening to renovations.

In 2025, with home prices expected to rise modestly amid stabilizing interest rates, direct ownership can generate strong rental income in growing markets. Imagine owning a rental property that not only covers its mortgage but builds equity over time.

Pros of Direct Real Estate

- Control and Potential for Higher Returns — You decide improvements, tenants, and timing, often leveraging debt for amplified gains through appreciation and forced equity.

- Tax Benefits — Deduct mortgage interest, property taxes, and depreciation; use 1031 exchanges to defer capital gains.

- Tangible Asset — Physical properties act as an inflation hedge with steady rental demand.

Cons of Direct Real Estate

- High upfront capital (typically 20-25% down) and ongoing property management hassles.

- Illiquidity — Selling takes months and involves costs.

- Concentration risk and vulnerability to local market volatility.

For beginners wondering about investing in real estate with little money 2025, options like house hacking or partnerships make entry possible, but it still demands more involvement than alternatives.

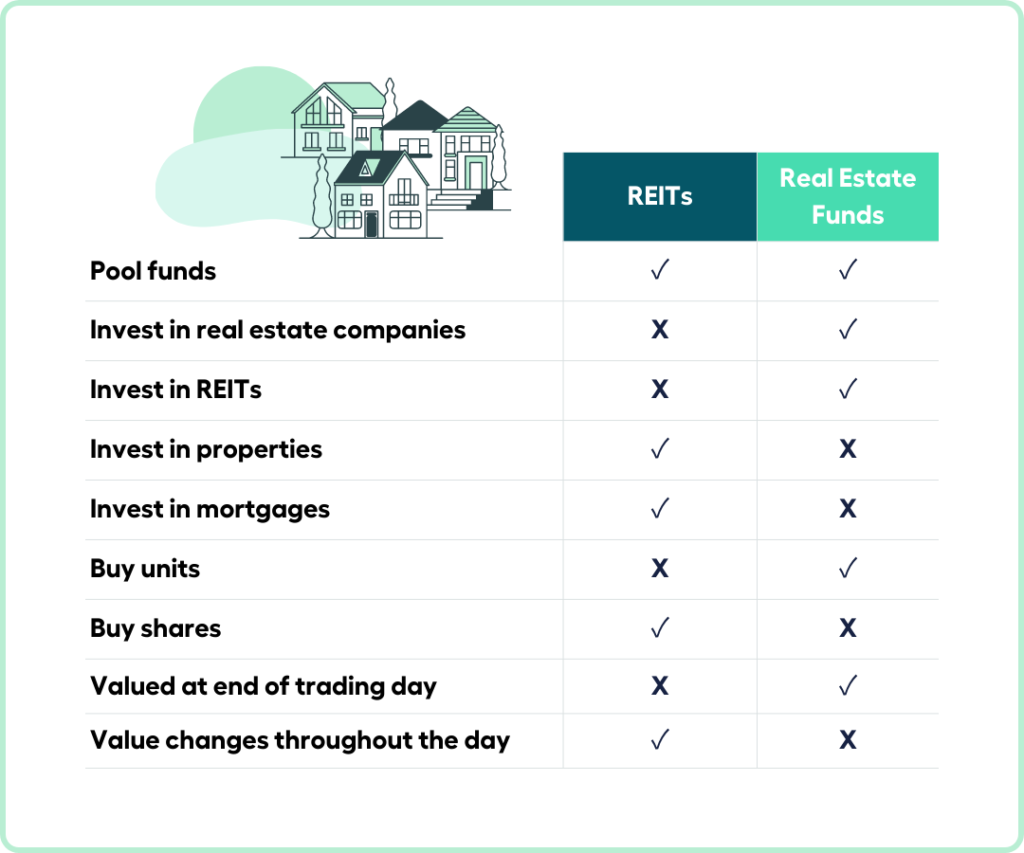

What Are REITs?

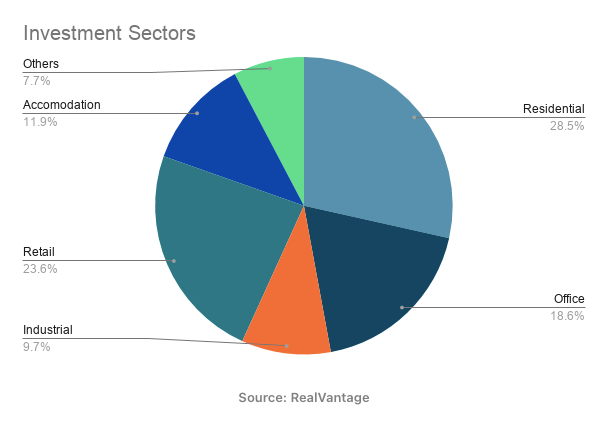

REITs are companies that own, operate, or finance income-producing real estate—like apartments, offices, data centers, or retail spaces. Publicly traded REITs function like stocks, offering easy buying and selling.

By law, REITs distribute at least 90% of taxable income as dividends, creating reliable dividend yield (averaging around 4% in late 2025). Analysts forecast total returns of 8-10% for 2025, driven by sectors like healthcare and industrials.

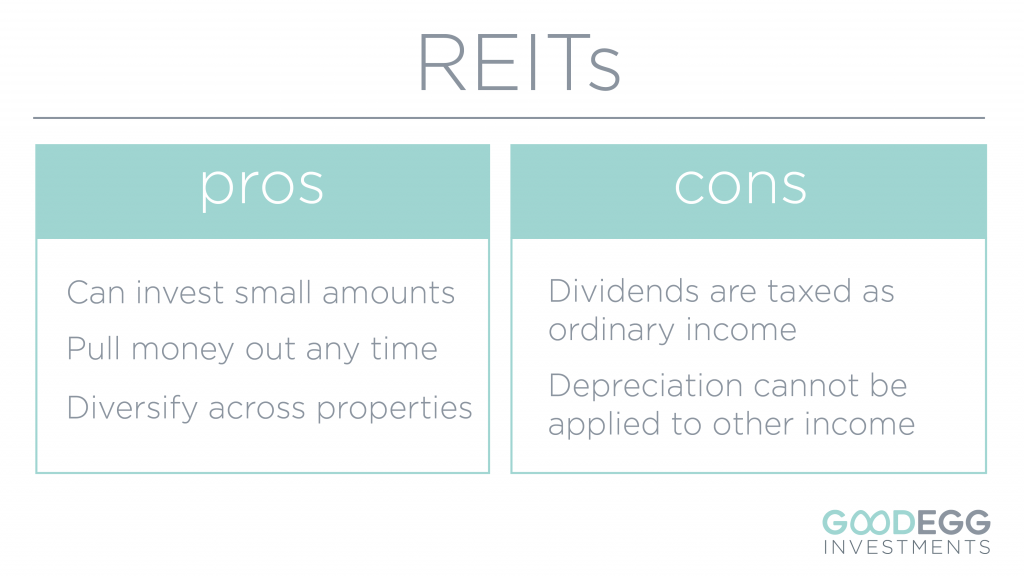

Pros of REITs

- Liquidity and Low Entry → Trade like stocks; start with one share.

- Diversification → Instant exposure to hundreds of properties across sectors and regions.

- Passive Income → Professional management with no tenant calls; strong for retirement streams.

- Hands-off appeal for REIT vs direct real estate investment pros and cons.

Cons of REITs

- No direct control; performance ties to stock market volatility.

- Dividends mostly tax as ordinary income (up to 37%, plus potential surtax), though a 20% qualified business income deduction applies through 2025.

- Less leverage than direct ownership, potentially capping upside.

READ ALSO: Real Estate Market Trends in 2026: Your Authoritative Guide

Key Comparisons: Real Estate vs. REITs in 2025

Here’s a side-by-side look at critical factors:

| Factor | Direct Real Estate | REITs |

| Entry Barrier | High (down payment + costs) | Low (buy shares for $10+) |

| Liquidity | Low (months to sell) | High (trade instantly) |

| Income Stream | Rental income + appreciation | High dividend yield (~4%) |

| Management | Active (or hire a manager) | Passive |

| Diversification | Limited (one or few properties) | Broad (portfolios of 100s of assets) |

| Tax Benefits | Strong (depreciation, 1031 exchanges) | Moderate (dividends taxed as ordinary; 20% deduction through 2025) |

| Risk | Property-specific + management | Market volatility + interest rate sensitivity |

| 2025 Outlook | Modest 3% appreciation; strong rentals | 8-10% total returns projected |

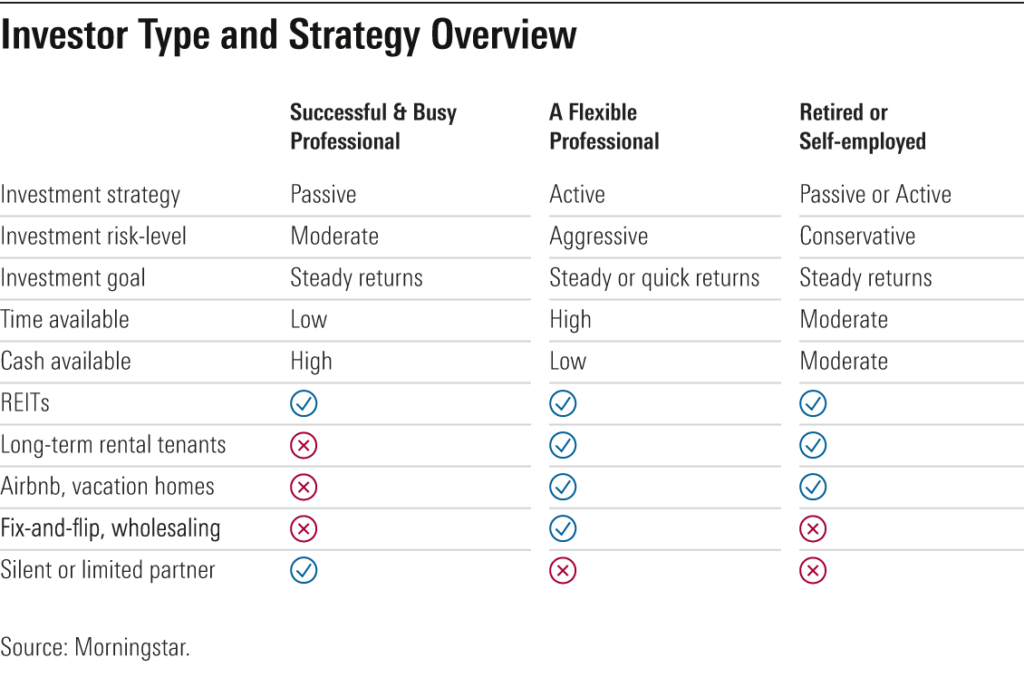

How to Choose Between REITs and Physical Real Estate

Ask yourself these questions:

- Time and Expertise? → Choose REITs if you want passive exposure. Opt for direct if you enjoy active involvement.

- Capital and Risk Tolerance? → REITs suit best real estate vs REITs which is better for beginners or limited funds. Direct fits those with down payment money seeking leverage.

- Income Needs? → REITs excel for steady dividends in retirement. Direct offers potential higher cash flow plus tax-sheltered growth.

- Tax Situation? → Direct provides superior benefits (real estate vs REITs which is better for tax benefits). REITs remain efficient with the current deduction.

- Safety Concerns? → REITs offer broader diversification (are REITs safer than buying rental property? Often yes, due to professional management and spread risk).

Many investors blend both for optimal asset allocation—REITs for liquidity and direct for control.

Conclusion

Neither direct real estate nor REITs is universally “better”—it depends on your lifestyle and goals. In 2025’s environment of stabilizing rates and moderate growth, REITs shine for easy, diversified passive income, while physical properties appeal for control, leverage, and tax advantages.

Evaluate your risk tolerance, time horizon, and finances. Consider consulting a financial advisor to model scenarios for your portfolio. Whichever path you choose, real estate remains a powerful tool for building long-term wealth. Start small, diversify, and align with what lets you sleep soundly at night.

YOU MAY ALSO LIKE: Real Estate Market Trends in 2026: What Buyers, Sellers, and Investors Should Expect