In an era of global economic shifts, the U.S. real estate market continues to attract high-net-worth international investors seeking stability and growth. With rising costs in many regions, properties here offer a resilient safe haven, backed by strong property rights protection and diverse opportunities. Yet, navigating this landscape requires understanding complex laws, taxes, and financing options.

This article serves as your comprehensive roadmap for foreign investment in local real estate. Whether you are an expat, corporate entity, or consultant, it breaks down key steps to make informed decisions. From legal requirements to tax strategies, we cover essentials to help you capitalize on the U.S. market’s potential, positioning it as a smart choice despite regulatory scrutiny.

Foreign buyers invested $42 billion in U.S. residential properties in 2024, purchasing 54,300 homes, often in cash. Trends suggest continued growth into 2026, driven by diversification needs.

Understanding Foreign Investment in Local Real Estate

Foreign investment in local real estate involves non-U.S. citizens or entities acquiring properties within the United States. This can include residential transactions for personal use or commercial real estate (CRE) for income generation.

Why pursue it? The U.S. market provides diversification, hedging against home-country risks, and access to appreciating assets. It is seen as a safe haven due to stable legal systems and economic resilience.

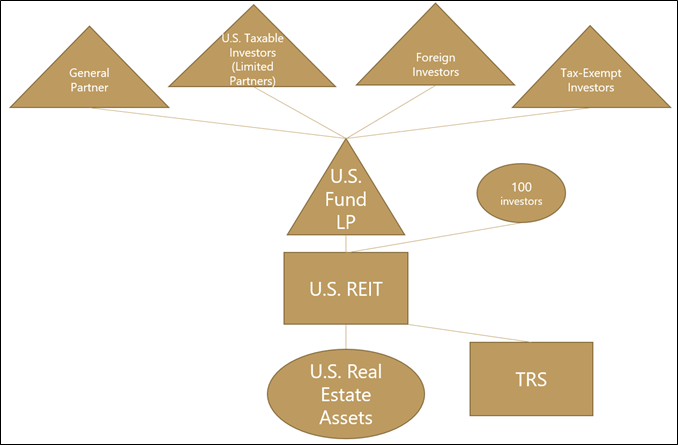

Types include direct ownership, partnerships, or indirect vehicles like Real Estate Investment Trusts (REITs). Each offers unique benefits, such as income from rentals or capital gains from sales.

International buyers from Canada, China, Mexico, India, and Colombia dominate, focusing on states with strong growth. In 2024, foreign activity rebounded, signaling renewed interest.

Imagine securing a Miami condo that generates steady rental income while appreciating over time. That is the appeal for many.

Benefits for International Investors

Stability stands out. Unlike volatile stocks, real estate offers tangible assets with predictable returns.

Diversification reduces exposure to single-market risks. For corporate entities, it expands portfolios.

Cross-border real estate consultants highlight long-term value, especially in growing sectors like multifamily housing.

Property rights protection ensures fair treatment, with U.S. laws safeguarding foreign owners equally.

Legal Requirements for Foreign Real Estate Buyers

Foreigners can buy U.S. property without citizenship or residency requirements. No federal bans exist, though some states impose limits.

For example, certain states restrict foreign ownership of agricultural land or near military sites. Florida requires registration for properties near critical infrastructure if owned by foreign principals from countries like China.

The Committee on Foreign Investment in the United States (CFIUS) reviews transactions for national security risks, especially near sensitive sites.

Buyers need a Taxpayer Identification Number (TIN), like an ITIN if no SSN. Due diligence includes title searches and reviewing building documents.

Structuring matters: Buy personally or via an LLC for liability protection.

Rhetorical question: Why risk personal assets when an entity shields you?

Real-world example: A Chinese investor forms an LLC to buy New York CRE, avoiding direct exposure.

State-Specific Considerations

Some states like Texas welcome foreign capital with minimal restrictions. Others, like Iowa, limit agricultural buys.

Recent laws in Florida and Montana target entities from “countries of concern,” requiring disclosures.

Check local rules early. For instance, North Dakota bans foreign governments from owning farmland.

Consultants advise starting with compliant states to avoid pitfalls.

Tax Implications of Foreign Investment in Local Real Estate

Taxes can erode returns if not managed. Foreign investors face unique rules.

The Foreign Investment in Real Property Tax Act (FIRPTA) mandates 15% withholding on gross sales proceeds when selling. This acts as a deposit against capital gains tax.

Capital gains tax applies to profits, treated as effectively connected income. Rates vary, but long-term gains (over one year) are 0-20%.

Rental income is fixed, determinable, annual, or periodical (FDAP), subject to 30% withholding unless electing trade or business treatment for deductions.

Estate tax hits foreign-owned property, with thresholds as low as $60,000.

Non-resident aliens must file returns if engaged in U.S. trade.

Tax optimization involves structures to minimize burdens.

Example: A Canadian buyer faces 15% FIRPTA on a $1M sale, but claims deductions to reduce actual liability.

How FIRPTA Works: A Step-by-Step Guide for Foreign Real Estate …

Impact of Treasury “Look-Through” Rules

Recent rules affect structures with foreign capital. Proposed changes may repeal look-through for domestically controlled REITs, easing restrictions.

This could boost foreign inflows by simplifying compliance.

For now, monitor updates as they influence entity choices.

Best U.S. States for International Property Investors

Choosing the right state maximizes returns. Factors include growth, taxes, and foreign-friendliness.

Top picks for 2026:

Texas (Dallas/Fort Worth): Leads prospects with job growth and diversification. No state income tax attracts investors.

Florida (Miami): Third in rankings, strong in hotels and retail. High foreign buyer share, five times national average.

New Jersey (Jersey City/Northern NJ): Second and seventh, urban appeal near NYC.

New York (Brooklyn/Manhattan): Fourth and ninth, global hub for CRE.

Tennessee (Nashville): Sixth, lifestyle and tourism draw.

These states offer supply-demand imbalances favoring investors.

Southeast regions score highest at 2.90 for prospects.

Table: Top States Comparison

| State | Key Attractions | Avg Home Price | Foreign Friendliness |

|---|---|---|---|

| Texas | Job growth, no income tax | $300,000 | High |

| Florida | Tourism, beaches | $400,000 | Very High |

| New Jersey | Proximity to NYC | $500,000 | High |

| New York | Urban opportunities | $600,000+ | Moderate |

| Tennessee | Music, culture | $350,000 | High |

Source: newsweek.com

Map Shows Where Foreign Citizens Are Buying Up U.S. Homes – Newsweek

Securing Financing for Foreign Real Estate Investment

Financing poses challenges without U.S. credit. Expect 30-50% down payments and higher rates.

Foreign national loans allow qualification using international credit. Lenders like Waltz offer up to 70% LTV without U.S. history.

Options: Portfolio lenders, cash-out refinances.

Steps: Get pre-approved, provide foreign docs like bank statements.

Example: An Indian investor secures a mortgage for NYC property with 40% down.

The Role of REITs in Cross-Border Real Estate

REITs provide indirect exposure without direct ownership hassles. Foreign investors benefit from dividends, often taxed favorably under treaties.

Domestically controlled REITs exempt sales from FIRPTA.

AFIRE notes $3T AUM from foreign members in U.S. property.

Structure: REIT holds assets, investors buy shares.

Bold: Tax optimization via REITs reduces ECI.

Source: eisneramper.com

Commercial vs. Residential Transactions

CRE offers scale, like office or retail. Residential suits personal use.

EB-5 Visa Through Real Estate Investment

The EB-5 visa grants green cards via investment. Minimum: $800,000 in targeted areas, creating 10 jobs.

Real estate qualifies if in regional centers.

Process: Invest, file I-526, get conditional residency, then permanent.

Ideal for families seeking U.S. residency.

Tax Optimization and Common Pitfalls

Strategies: Use blockers like corporations to avoid estate tax.

Pitfalls: Ignoring FIRPTA leads to unexpected withholding. Solution: Apply for certificates.

Overlooking state taxes or CFIUS reviews.

Always consult experts.

In summary, foreign investment in local real estate offers robust opportunities in 2026, with the U.S. market’s resilience shining through. Key takeaways include mastering FIRPTA, choosing investor-friendly states like Texas and Florida, and leveraging REITs for efficiency. For personalized guidance, consult a cross-border real estate consultant or tax advisor today to secure your next investment.

READ ALSO: Real Estate Market Trends in 2026: Your Authoritative Guide